Tax Reform

- Filter by

- Categories

- Tags

- Authors

- Show all

- All

- 529 Savings Plan

- Business Accounting

- Charities

- Coronavirus

- Covid-19

- Cryptocurrency

- Debt Relief

- Entrepreneur

- Health Savings Account

- Hiring new Employees

- Identity Theft

- Investing

- IRA

- IRS

- Payment Protection Plan

- Real Estate

- Receiving Tips

- Retirement

- Roth IRA

- Saving for College

- Scams

- Small Business Payroll

- Stimulus Checks

- Stocks

- Tax Reform

- Taxes

- Uncategorized

October 6, 2020

Categories

Article Highlights: Earned Income Tax Credit Refundable Tax Credit Qualifications Special Rule for Military The EITC is for people who work but have lower incomes. If […]

September 10, 2020

Categories

Article Highlights: General statute is 3 years Some states are longer Fraud, failure to file and other issues can extend the statute Records to dump Record […]

August 11, 2020

Categories

Article Highlights: Repercussions of Incorrect Tax Returns Filing Amended Returns Statute of Limitations for Refunds Potential of Audit It is not uncommon to discover that an […]

July 28, 2020

Categories

Article Highlights: Self-employed taxpayers Underreported income Unscrupulous tax preparers Phony deductions or credits Inflating the Earned Income Tax Credit Taking fake education credits Petty cheating Some […]

July 7, 2020

Categories

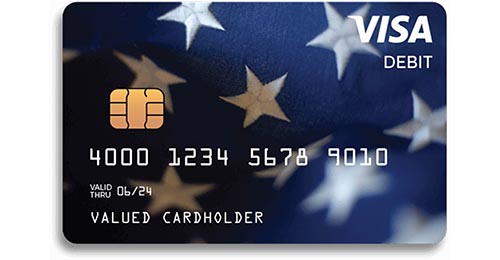

Some Are Being Mistaken as Junk Mail and Thrown Out Article Highlights: Junk Mail Stimulus Payment Debit Card If you are like most Americans, you receive […]

June 26, 2020

Categories

Article Highlights: Charitable Contributions Business-Related Charitable Contributions Charitable Pass-Through Deductions 20% Business Pass-Through Deduction Charitable contributions are generally allowed as part of an individual’s itemized […]

June 23, 2020

Article Highlights: Loan Forgiveness Confusion Covered Period Extended Loan Maturity Extended Limit on Expenses other than Payroll Reduced Exemptions for Those Unable to Rehire or Replace […]

April 24, 2020

Categories

Article Highlights: Appropriations Act of 2020 Children’s Tax-Filing Requirements Two Methods for 2018 and 2019 Amendment Possibility for a Dependent Child Standard Deduction Wages Self-employment Income […]

March 27, 2020

Categories

Article Highlights Qualified Charitable Distributions (QCDs) Required Minimum Distribution Age Limit Repealed for Traditional IRA Contributions Coordination of QCDs and Deducted Traditional IRA Contributions Ever since […]