October 6, 2020

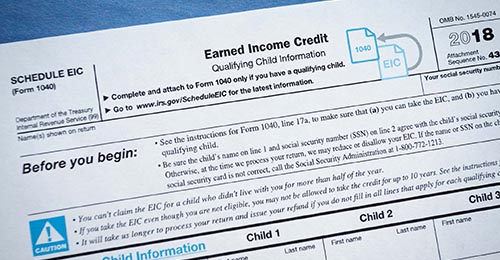

Article Highlights: Earned Income Tax Credit Refundable Tax Credit Qualifications Special Rule for Military The EITC is for people who work but have lower incomes. If […]

September 29, 2020

Article Highlights: Underpayment of Estimated Tax and Withholding Penalty Required Minimum Distribution Penalty Late Filing Penalty Late Payment Penalty Negligence Penalty Fraud Penalty Dishonored Check Penalty […]

September 22, 2020

Article Highlights: Medical Savings Account Retirement Account High-Deductible Plan Eligible Individuals Monetary Qualification for an HSA Qualification Chart Maximum Contributions Establishing an HSA Qualified Medical […]

September 15, 2020

Regardless of the type of business you’re running, it’s safe to say that you’ve likely already been impacted by the ongoing COVID-19 pandemic that is making […]

September 10, 2020

Article Highlights: General statute is 3 years Some states are longer Fraud, failure to file and other issues can extend the statute Records to dump Record […]