July 28, 2020

Article Highlights: Self-employed taxpayers Underreported income Unscrupulous tax preparers Phony deductions or credits Inflating the Earned Income Tax Credit Taking fake education credits Petty cheating Some […]

July 21, 2020

Article Highlights: Donating unused vacation time, sick leave and personal time Employer’s Function Great Donation Opportunity On March 13, 2020 the President issued an emergency disaster […]

July 14, 2020

Article Highlights: 2020 Tax Saving Opportunities Traditional IRA to Roth IRA Conversions Paying the Conversions Tax Required Minimum Distribution (RMD) 2020 RMD Waiver Coordinating Distributions with […]

July 7, 2020

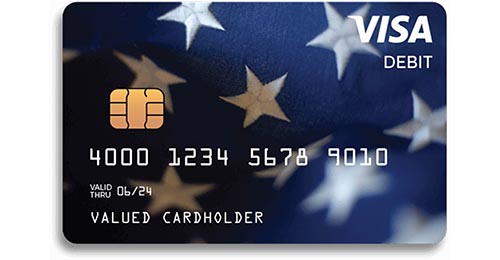

Some Are Being Mistaken as Junk Mail and Thrown Out Article Highlights: Junk Mail Stimulus Payment Debit Card If you are like most Americans, you receive […]

June 26, 2020

Article Highlights: Charitable Contributions Business-Related Charitable Contributions Charitable Pass-Through Deductions 20% Business Pass-Through Deduction Charitable contributions are generally allowed as part of an individual’s itemized […]